Your Company’s Ultimate Guide to Tax Deductions and Incentives

Where do you start when it comes to Tax Deductions and Incentives?

We all have work budgets. Consider this your reminder to use those unspent budget dollars. Put these dollars towards energy efficient equipment that qualify for IRS Section 179 tax deductions and incentives. Not only that, but by replacing your compressed air system and/or industrial robotic equipment, you could save thousands on energy costs, labor and provide better solutions to sustain energy consumption for years to come.

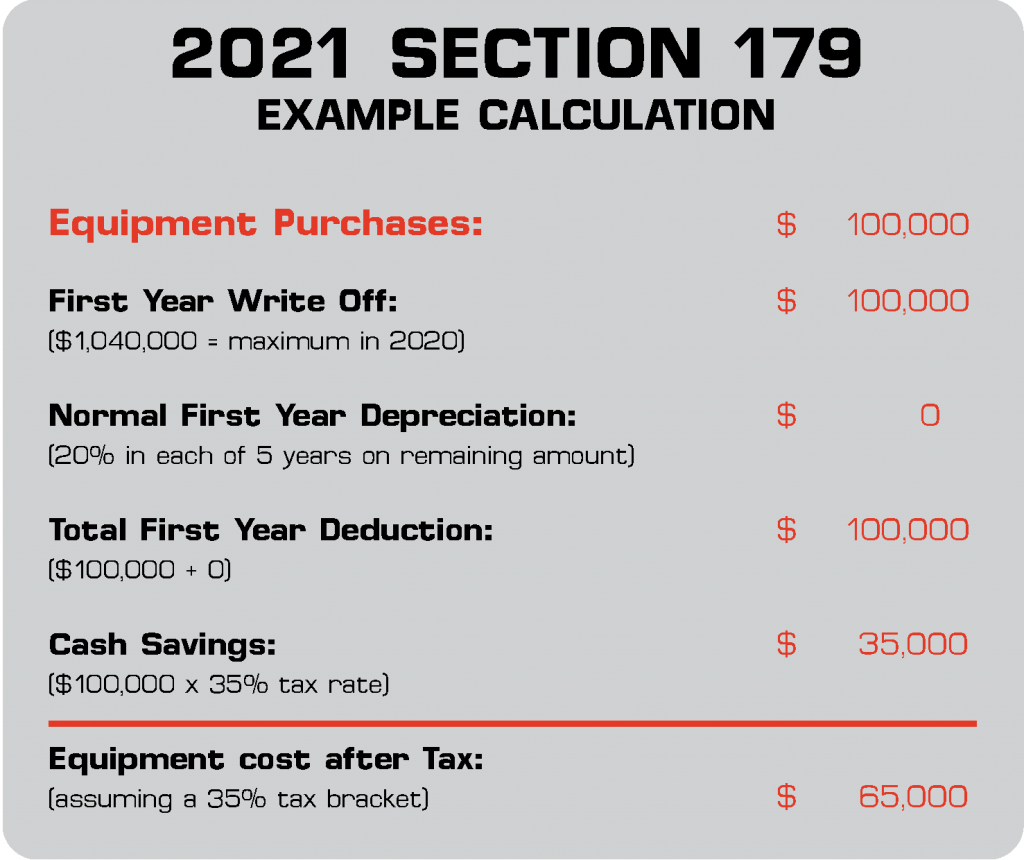

Thanks to the IRS Section 179 guidelines of the Federal Tax Code, businesses (large or small) investing in new equipment may be eligible to deduct the full purchase price of the equipment in the year it is placed in service. Qualifying equipment up to $1,040,000 annually is allowed, with the full deduction taking place in the current tax year. As opposed to spreading it out over the life of the equipment.

Five Steps to See if You Qualify for End of Year Tax Deductions and Incentives

STEP ONE:

Review your budget. What type of moneys do you have available and would management agree to look at ROI if the budget isn’t there? Need help figuring out your calculations? Utilize our ROI Calculator when it comes to implementing a robot.

STEP TWO:

Review your timeline. Does the calendar year and your schedule allow for you to evaluate your equipment, get approval, review a quote and move forward with a purchase order with an install included before the year ends or is this something that will qualify for the following year?

STEP THREE:

Set an appointment with your tax adviser to see if your business qualifies for the Section 179 deduction.

STEP FOUR:

Contact your energy provider. Energy suppliers like Xcel Energy or Focus on Energy know that equipment provide inefficiencies. Because of this, they provide study funding for compressed air systems. Once your study is completed, an expert can help you implement improvements through prescriptive rebates and suggest the types of incentives available on certain equipment.

STEP FIVE:

Routinely examining compressed air systems can help identify areas that waste energy. Find an expert to perform an air system study on your equipment. JHFOSTER has been performing air studies for over 80 years. We can detect leaks, determine the best equipment and power requirements, suggest cost efficient solutions, install equipment, integrate the supply and demand side of your equipment and take operation manuals in consideration when it comes to warranty, servicing and maintaining your equipment.

Do these steps really work when it comes to receiving tax deductions and incentives?

A manufacturing company JHFOSTER worked closely with was able to acquire a $168,000 rebate from a power company. Whereas, another business – a publishing firm – received a return on investment in less than 2 years by reducing leak loss through new equipment. Pretty incredible. Find more relatable case studies in our library.

Still not sure where to start? JHFOSTER has experts standing by to answer any end of year equipment questions so you don’t miss out on receiving End of Year Tax Deductions and/or Incentives available. You can also, call JHFOSTER at 800.582.5162.